Most taxpayers opt to hire professionals to prepare their tax returns. Tax professionals understand the complexities of deductions, credits, and reporting requirements that can overwhelm even sophisticated business owners and investors.

Once the tax returns are filed and a few years pass without incident, most taxpayers reasonably assume those tax years are closed forever. But what happens when that trusted professional turns out to be fraudulent?

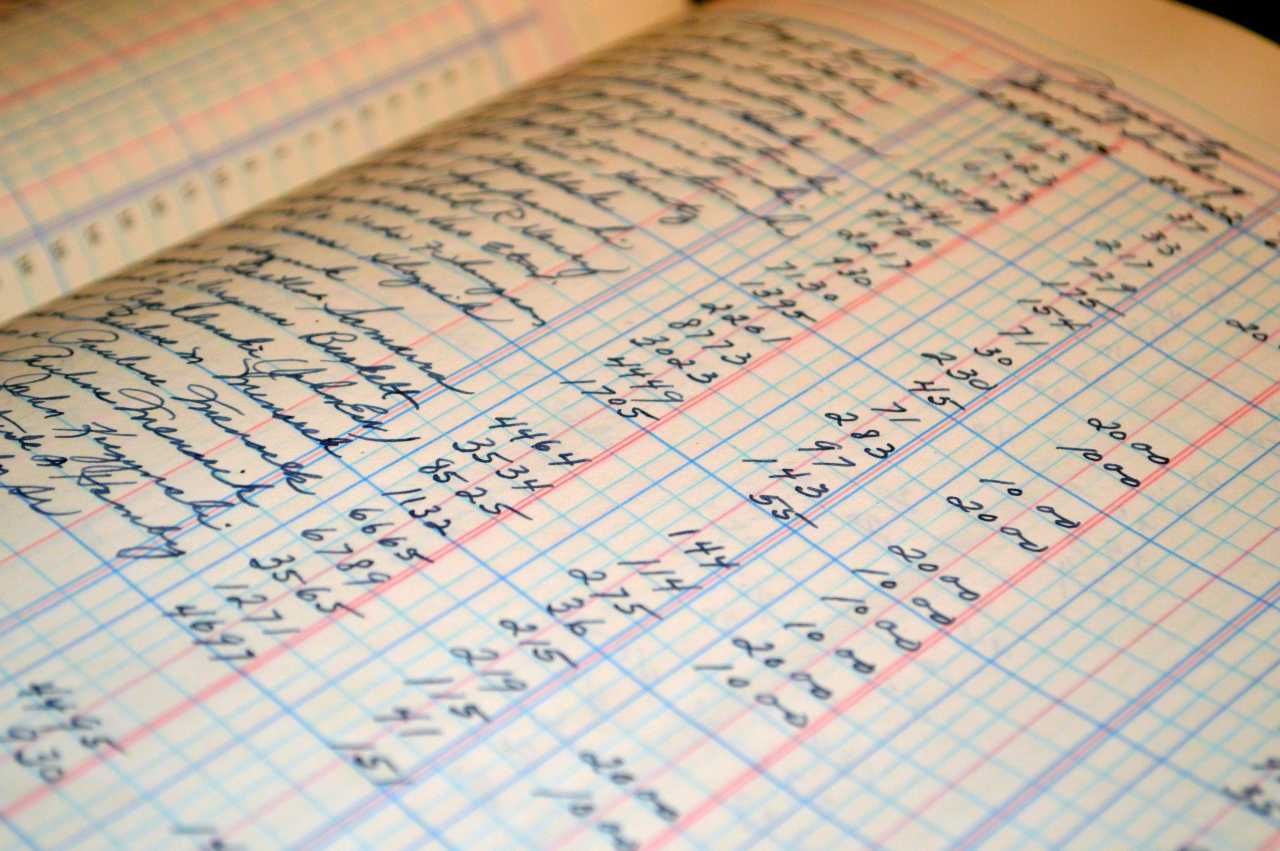

Consider the business owner who discovers, decades later, that their long-retired tax preparer deliberately falsified deductions and manipulated numbers to reduce tax bills—all without the owner’s knowledge. The IRS typically has just three years to assess additional taxes. Yet when fraud enters the picture, that three-year window can disappear entirely, even if the taxpayer had no idea about the deception.

In Murrin v. Commissioner, No. 23-1234 (3d Cir. Aug. 18, 2025), the Third Circuit confronted this situation. It is another circuit court that was asked to determine whether the phrase “intent to evade tax” in Section 6501(c)(1) requires the taxpayer’s own fraudulent intent or whether a preparer’s fraud alone can expose an innocent taxpayer to unlimited assessment periods.

Contents

Facts & Procedural History

Murrin hired Tax Preparer Howell. Howell had included false or fraudulent entries on her tax returns for the years 1993 through 1999. These fraudulent entries resulted in substantial underpayments of tax. It was not disputed that Howell acted with intent to evade tax, or that Murrin herself had no knowledge of the fraud and no intent to evade her tax obligations.

More than two decades later, in 2019, the IRS issued a notice of deficiency to Murrin regarding these old tax returns. The IRS tax collection function then sought to collect $65,318 in unpaid taxes, plus $13,064 in accuracy-related penalties and an estimated $250,000 in interest.

Murrin didn’t dispute that she owed the underlying tax. She agreed with the IRS’s calculations of the deficiency and didn’t challenge the accuracy-related penalties. Instead, she raised a statute of limitations defense, arguing that the IRS’s assessment came too late. Under the normal rules, the IRS must assess tax within three years of when a return is filed.

When Murrin received the IRS Notice of Deficiency, she petitioned the U.S. Tax Court for a redetermination. The tax court sided with the IRS as Section 6501(c)(1) includes an exception to the statute of limitations for false or fraudulent returns with intent to evade tax. Murrin then appealed to the Third Circuit, which decided this case.

The Statute of Limtimations for Tax Assessments

Section 6501(a) sets out the general rule for tax assessments. The IRS has to assess or record the balance due for any tax within three years after the tax return was filed.

This protects taxpayers from indefinite exposure to unpaid tax debts and provides finality to tax matters. The three-year period gives the IRS sufficient time to review returns and identify potential issues while allowing taxpayers to move forward without perpetual uncertainty.

The statute defines assessment as the formal recording of a tax liability—essentially, what the taxpayer owes the government. Before making an assessment, the IRS has to follow specific procedures. This includes issuing a notice of deficiency that tells the taxpayer what the IRS believes is owed. Once a taxpayer receives this notice, they can challenge the IRS’s position in U.S. Tax Court before any assessment occurs or wait, file a refund claim, and then file suit in district court.

The three-year rule isn’t absolute. Section 6501(c) includes numerous exceptions that extend or eliminate the assessment period. These exceptions cover various situations in which Congress determined the standard limitations period would be inappropriate. Some exceptions extend the period to six years, such as when a taxpayer omits substantial income from their return. Others eliminate the limitations period entirely.

The Fraud Exception Under Section 6501(c)(1)

Section 6501(c)(1) states that “[I]n the case of a false or fraudulent return with the intent to evade tax, the tax may be assessed, or a proceeding in court for collection of such tax may be begun without assessment, at any time.” This unlimited assessment period reflects Congress’s judgment that fraudulent conduct warrants extraordinary remedies.

The language creates two requirements for the exception to apply. First, there must be a “false or fraudulent return.” Second, this return must be filed “with the intent to evade tax.” This allows the IRS to assess tax or pursue collection at any time—whether three years, thirty years, or longer after the return was filed.

This exception serves policy goals. False or fraudulent returns undermine the integrity of the self-assessment system that underlies federal taxation. Allowing fraudsters to benefit from a limitations period would reward deception and encourage tax evasion. The unlimited assessment period ensures that those who deliberately cheat on their taxes cannot simply wait out the clock.

Whose Intent Matters? The Core Interpretive Question

The central question in Murrin was simple: when Section 6501(c)(1) refers to “intent to evade tax,” whose intent counts? Must it be the taxpayer’s intent, or can a third party’s fraudulent intent trigger the exception?

The Third Circuit began its analysis with the statutory text. The court noted that Section 6501(c)(1) contains no express limitation to taxpayer intent. The statute doesn’t say “the taxpayer’s intent to evade tax” or “filed by the taxpayer with intent to evade tax.” Instead, it uses passive voice—focusing on the existence of a false or fraudulent return with intent to evade tax, without specifying who must possess that intent.

The court found this passive construction significant. By drafting the statute to focus “on an event that occurs without respect to a specific actor,” Congress indicated it was “agnostic about who” possessed the fraudulent intent. The structure emphasizes the character of the return itself—that it is false or fraudulent and filed with evasive intent—rather than the identity of the bad actor.

Murrin argued that common sense supported limiting the exception to taxpayer intent. After all, the tax evaded belongs to the taxpayer, and the return is the taxpayer’s return. Reading the statute to include third-party fraud would produce an unfair result, exposing innocent taxpayers to unlimited assessment periods based on others’ misconduct.

The Role of Precedent in Similar Cases

The Third Circuit drew support from recent Supreme Court decisions interpreting similar passive-voice constructions. In Bartenwerfer v. Buckley, the Court analyzed a bankruptcy provision stating that debts “obtained by . . . fraud” cannot be discharged. The debtor argued this meant only debts obtained by the debtor’s own fraud were non-dischargeable.

The Supreme Court unanimously rejected this argument. The passive voice “pulls the actor off the stage,” focusing on the fraudulent nature of the transaction rather than the identity of the fraudster. The Court emphasized that Congress’s use of passive voice indicated it was “agnostic about who” committed the fraud.

The Third Circuit found Bartenwerfer‘s reasoning directly applicable. Like the bankruptcy provision, Section 6501(c)(1) uses passive voice to describe fraudulent conduct without identifying the required actor. This grammatical choice suggests Congress cared about the existence of fraud, not the fraudster’s identity.

The court also cited Badaracco v. Commissioner, where the Supreme Court interpreted Section 6501(c)(1) broadly. Badaracco held that filing an amended, non-fraudulent return doesn’t restart the limitations period when the original return was fraudulent. The Court emphasized that statutes of limitations protecting government revenue “must receive a strict construction in favor of the Government.”

The Third Circuit acknowledged that its holding created a circuit split. The Federal Circuit had previously held in BASR Partnership that Section 6501(c)(1) requires taxpayer intent. That court relied heavily on legislative history and policy concerns rather than statutory text.

The Third Circuit respectfully disagreed with the Federal Circuit’s approach. Writing after Bartenwerfer provided clearer guidance on interpreting passive-voice provisions, the Third Circuit found the text and structure of Section 6501(c)(1) dispositive. The court aligned itself with the dissenting opinion in BASR, which argued that “the obvious construction of the statutory text is that the intent to evade tax must be present in a false or fraudulent return, irrespective of who possesses that intent.”

The Second Circuit had previously suggested agreement with the Third Circuit’s interpretation in City Wide Transit, Inc. v. Commissioner. There, the court stated that “the limitations period for assessing [the taxpayer’s] taxes is extended if the taxes were understated due to fraud of the preparer.” However, that statement may have been influenced by the taxpayer’s concession on appeal.

The Fifth Circuit’s decision in Payne v. Commissioner didn’t directly address the issue. While Payne discussed fraudulent intent “on the part of the taxpayer,” it did so because the taxpayer’s intent was the only issue in that case. The court never considered whether third-party fraud could trigger Section 6501(c)(1).

The Takeaway

The Third Circuit’s holding continues the question about fairness to innocent taxpayers. Murrin faced tax assessments totaling over $300,000 for returns filed decades ago, all because of her preparer’s fraud. She had no knowledge of the fraud and no intent to evade tax. Many would view this result as fundamentally unfair.

The court acknowledged these concerns but emphasized its obligation to apply the statute Congress wrote, not the statute it might prefer. While the result seems harsh, the court noted that taxpayers retain other protections. They can still challenge accuracy-related penalties by showing reasonable cause and good faith. They may have claims against fraudulent preparers for damages.

The decision also reflects practical realities of tax administration. Fraudulent preparers often file false or fraudulent tax returns for multiple clients over many years. Requiring the IRS to prove each individual taxpayer’s knowledge and intent would make enforcement extremely difficult. Many fraudulent schemes might go unpunished if the government had to meet this higher burden.

From a compliance perspective, the ruling emphasizes the importance of choosing reputable tax professionals. Taxpayers must exercise due diligence in selecting preparers, as they bear the risk of preparer misconduct. This may encourage taxpayers to ask more questions about their returns and maintain better records of their tax preparation process.

Watch Our Free On-Demand Webinar

In 40 minutes, we'll teach you how to survive an IRS audit.

We'll explain how the IRS conducts audits and how to manage and close the audit.