IRS Audit Letter: The Correspondence Audit

You probably found this page as you received an IRS audit letter or IRS certified mail and you want to know how to respond to the letter. You may be searching for an example of an IRS response or even what your response letter should look like.

If you received an IRS audit letter, here’s what you need to know and what to do.

We explain what an IRS audit involves, what IRS examination letters you may receive, and how to respond to them.

What is Tax Audit?

A tax audit is an examination to verify that you reported your taxes correctly. For income tax audits, this involves checking the items of income, tax deductions, and tax credits reported on your tax return.

If you did not file a tax return, the tax audit may involve gathering information so that the IRS can compute your tax liability.

Congress authorized the IRS to conduct audits. Section 7602(a) says that the IRS can “examine any books, papers, records, or other data which may be relevant or material” to your tax return or tax liability.

The IRS audit is a process. If you received an IRS audit letter, you are in the IRS audit process. You will have to take some action to end the process. This usually means that you have to provide records and information to the IRS as explained in this article.

What is a Correspondence Audit?

IRS audits are usually field audits or correspondence audits. Field audits involve one or more in-person visits by an IRS agent. They often involve more complex issues and can cover a number of different issues. The IRS agents who handle field audits will usually want to visit business owners at their place of business (in most cases taxpayers should decline requests to meet at their place of business).

Correspondence audits are handled entirely by mail and, in some cases, by phone. If you received an IRS audit notice, it is likely for a correspondence audit. Correspondence audits focus on less complex issues and are usually limited to very specific items.

The IRS employee who handles correspondence audits is usually not an IRS agent. The IRS officer for correspondence audits is usually a tax compliance officer. They are a lower-grade employee. They are usually not as well trained as IRS agents are.

Most IRS audits are correspondence audits. IRS statistics show that 80 percent of all IRS audits are correspondence audits. These same statistics show that these audits result in less than 50 percent of the tax collected from audits. Why is this? It is because the audits focus on tax issues that produce much less tax revenue for the IRS.

Why does the IRS prefer correspondence audits? The short answer is that they are cheaper to conduct on a mass scale. The IRS philosophy for auditing tax returns is that it should “touch as many returns as possible.” The IRS believes that its increased visibility encourages more taxpayers to voluntarily comply with our tax laws.

This tactic makes sense given the low audit rate. The IRS audit rate is so low that this is the only way that many taxpayers ever even hear about an IRS audit.

What Does IRS Audit Letter Look Like?

The IRS letter will usually be sent by certified mail (yes, you should pick up any IRS certified mail that you receive).

The IRS will send you a Letter 2202B or a Letter 566 for a correspondence audit (and sometimes a Letter 718).

Alternatively, the IRS may issue one of the following letters:

- Letter 566-S, Initial Contact Notifying Taxpayer of Examination and Requesting Additional Supporting Documentation;

- Letter 525, Proposed Letter of Change to Return and Appeal Rights General 30-Day Letter;

- Letter 2269, Delinquent Individual Return

You can find these letter numbers on the bottom right-hand side of the letter.

The letter itself will list the IRS office that sent the letter on the top left-hand side of the letter. The letter will usually be issued by the Internal Revenue Service, Small Business/Self-Employed (“SB/SE”) Division.

The top right-hand side of the letter will list the IRS contact person, their employee identification number, and usually their phone and fax numbers and contact information.

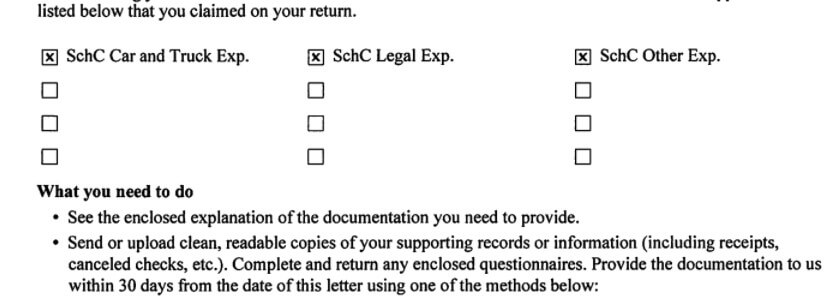

The body of the letter will usually include a list of issues that will be examined. The IRS auditor may just list the items they will focus on, or they may leave all of the items on the form letter and just check the boxes next to the items that will be examined.

What Causes You to Get Audited by the IRS?

This question is important as it helps you determine how you need to respond to the audit. There are usually very specific reasons why your tax return was selected for audit. Most audits are not due to a random sample of returns the IRS pulls for audit.

It may be that your tax return did not pass computer screening. The IRS computer system has the ability to match basic items reported on your return to third-party data (such as Forms W-2, Forms 1099, etc.). The IRS also uses statistical formulas to identify returns for audit.

Generally, the IRS audit letter is triggered by various reasons like missing information, inconsistent data, or activities that are not reported on your tax return. The IRS will need to collect additional information to verify whether you correctly reported this information on your tax return.

Correspondence audits usually focus on issues such as itemized deductions, earned income tax credits, and tax filing status, such as head of household filing status and exemptions for a qualifying child.

Luckily, you usually do not have to guess what the IRS agent is looking for. The IRS audit letter will usually identify the issues that will be examined.

You should know that the IRS may look at other items if you present a record or information to the IRS that shows that there is another tax problem. Income is an example. The IRS may ask for bank statements to verify deductions. If you provide the bank statements, the IRS agent will also look at the deposits. If the deposits exceed the amount of income reported on your tax return, the IRS agent will likely ask more questions about it or propose an adjustment for your income.

The IRS agent may also expand the audit to later years if it determines that there is a tax issue in the current year. IRS agents are supposed to do this; however, they often fail to do so.

How Far Back Can IRS Audit?

The general rule is that the IRS can go back and audit the prior three years. This general rule only applies if you file a tax return. There are nuances, but generally, the three-year period starts on the date the IRS receives your tax return.

The IRS usually does not go back to prior years for correspondence audits. The IRS will usually stick to the years pulled for audit that are noted in the IRS audit letter. Repetitive audits are not common for correspondence audits.

The IRS agent may pull any related tax returns, such as a business or trust tax return. These related examinations are extremely rare with correspondence audits.

How Do I Respond to an IRS Audit Letter?

The first step is usually to make a phone call to the IRS agent. This can help you gather information as to what the IRS agent thinks is important and what will be their primary focus.

If you lost your IRS audit letter, you should contact the IRS’s 800 number and ask for the name and number for the IRS agent assigned to your case. The IRS representatives can usually connect you with the audit group manager who can provide you with the IRS agent’s contact information.

If the IRS is asking for proof of tax deductions or support for tax credits, you should go above and beyond in pulling and providing supporting records. This includes reaching out and getting records that you do not currently possess.

There is no format for submitting the response letter to the IRS. Your audit response letter can be a simple cover letter with attachments is fine. It is advisable to include the IRS audit notice as the first attachment you send to the IRS with your audit response letter. Your letter should also list each document that is being provided to the IRS auditor. This will help create a record of what is being provided to the IRS. You should also include your contact information in your response.

If the IRS is asking for proof of income, you may want to consider providing more limited information. The IRS will usually ask for your bank records. If you provide these records to the IRS (or if they get them directly from your bank), you want to add up the deposits and see how they compare to the income reported on your tax returns. Non-taxable items should be identified before the IRS agent asks for them. This includes loan proceeds, gifts, insurance proceeds, and other amounts you may have received.

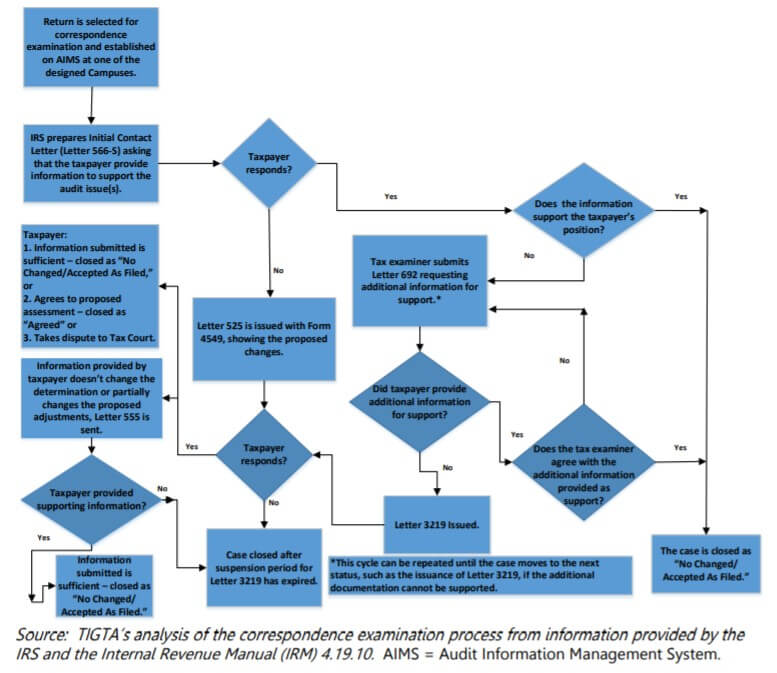

The IRS will then respond with a determination letter (described below) or a Letter 692, Request for Consideration of Additional Findings. The Letter 692 is used to request more information before a determination is made for the audit.

If you want to see the actual steps in the process, you can study this flowchart that was prepared by the Treasury Department:

How Long Does an IRS Audit Take?

IRS audits can go on for some time. The IRS is not fast.

At most the IRS usually has three years, but you can agree to extend the time for the audit.

Correspondence audits do not last this long. Correspondence audits usually last only three to six months.

This is a question that you can (and usually should) ask the IRS auditor if you get a chance to talk to them. The IRS agent should be able to provide you with an estimate of how long the audit might take.

How Does a Correspondence Audit End?

The IRS audit will end with the IRS providing something to you in writing. It may be a no-change letter (which accepts your tax return as filed) or a Revenue Agent’s Report (“RAR”).

The IRS audit no change letter is the letter you hope to receive.

The RAR will typically include a cover letter and forms that compute the additional tax you owe.

The IRS’s letter will explain how you are to respond if you do not agree. This will often involve filing a written protest to request a conference with the IRS Office of Appeals (this type of letter is often referred to as an IRS audit 30 day letter). The IRS letter may also include the IRS managers contact information. You may want to contact the IRS manager to see if you can resolve the case with him or her. While rare, these group manager meetings can sometimes produce good results.

It may also require that you file a petition with the U.S. Tax Court (see how to respond to an IRS Notice of Deficiency). Again, the IRS letter will explain what your options are to contest the audit determinations.

Get Help With Your IRS Audit

There is no substitute for experience in conducting and managing audits. This is not an area for novices or others who do not handle audits regularly.

An experienced tax attorney who regularly handles audits should be engaged to handle the audit.

We help clients with IRS audits. Please call us at (713) 909-4906 to discuss your IRS audit or appeal with our tax attorneys.

Recent IRS Audit & Appeals Articles

- Sidestep Tax Court Review by Applying Overpayments

What happens when a taxpayer properly invokes their right to challenge the underlying tax liability through the CDP process, but the IRS then uses subsequent overpayments to zero out the disputed balance? Can the IRS effectively eliminate tax court jurisdiction… Continue reading Sidestep Tax Court Review by Applying Overpayments

What happens when a taxpayer properly invokes their right to challenge the underlying tax liability through the CDP process, but the IRS then uses subsequent overpayments to zero out the disputed balance? Can the IRS effectively eliminate tax court jurisdiction… Continue reading Sidestep Tax Court Review by Applying Overpayments - Can Limited Partners be Subject to Self-Employment Tax?

Investment funds are often structured as limited partnerships. These partnerships allow professional managers to pool investor funds while maintaining operational flexibility. These structures typically have a general partner (“GP”) who manages day-to-day operations. Limited partners (“LP”) provide the capital and… Continue reading Can Limited Partners be Subject to Self-Employment Tax?

Investment funds are often structured as limited partnerships. These partnerships allow professional managers to pool investor funds while maintaining operational flexibility. These structures typically have a general partner (“GP”) who manages day-to-day operations. Limited partners (“LP”) provide the capital and… Continue reading Can Limited Partners be Subject to Self-Employment Tax? - Substantial Variance Doctrine for Informal Tax Refund Claims

Taxpayers often submit refund claims when they discover that they overpaid their taxes. Taxpayers usually do this by submitting a formal refund claim using the IRS’s prescribed forms. But this is not always required. In many cases, taxpayers will submit… Continue reading Substantial Variance Doctrine for Informal Tax Refund Claims

Taxpayers often submit refund claims when they discover that they overpaid their taxes. Taxpayers usually do this by submitting a formal refund claim using the IRS’s prescribed forms. But this is not always required. In many cases, taxpayers will submit… Continue reading Substantial Variance Doctrine for Informal Tax Refund Claims

Read more about IRS audits and IRS appeals.

In 40 minutes, we'll teach you how to survive an IRS audit.

We'll explain how the IRS conducts audits and how to manage and close the audit.